- Wartime sacrifice gets weirder

- A Wall Street-D.C. hack on the “liberal world order”

- Ready to offer up your sons (or grandsons) to the draft?

- Jerome Powell grimaces for the camera

- Zach Scheidt: opportunities in the current market

- The media ignore a Dutch resistance movement

- Readers inventory helium.

This whole wartime sacrifice thing is getting weird.

This whole wartime sacrifice thing is getting weird.

In the days leading up to Russia’s invasion of Ukraine, the Biden administration was trying out lines about how “defending freedom” and “standing up for our values” would come at a cost.

Soon after the invasion, gasoline prices were shooting higher and the campaign went off the rails — as wealthy pundits and Hollywood personalities started lecturing us lumpen about how it was our duty to suffer for the sake of “putting the screws to Putin.”

Four months later, the messaging is even more tone-deaf and it’s coming direct from the White House.

Four months later, the messaging is even more tone-deaf and it’s coming direct from the White House.

Asked last week by a New York Times reporter how long he expects Americans to pay high gasoline prices as a result of sanctions targeting Russia, Joe Biden said “as long as it takes” so that “Russia cannot defeat Ukraine.”

“The reason why gas prices are up is because of Russia,” he added later. “Russia, Russia, Russia.”

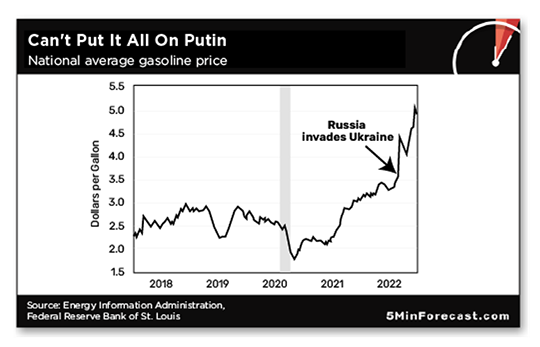

Uh… No, no, no. The national average gasoline price at the time of the invasion was already $3.61 — compared with $2.71 a year earlier. You want a comparison with pre-pandemic years? For most of 2019, it was below $2.75.

Meanwhile, a top aide to the president tried to make Americans’ sacrifices sound more high-minded.

Meanwhile, a top aide to the president tried to make Americans’ sacrifices sound more high-minded.

Deese’s title, by the way, is director of the National Economic Council — the post held by Larry Kudlow under Trump.

At age 44, Deese is the ultimate revolving-door Wall Street-Washington creature. He was “senior adviser” to Barack Obama before heading off to BlackRock for a few years and then back to the White House.

Well, as long as Deese brought it up, maybe we should contemplate for a moment what that term — “liberal world order” — really means.

Well, as long as Deese brought it up, maybe we should contemplate for a moment what that term — “liberal world order” — really means.

Thirty years ago, with Soviet-style communism consigned to the dustbin of history, people throughout the developed world broadly understood and agreed upon the hallmarks of the liberal world order, even if they didn’t call it that — a market economy, parliamentary democracy, rule of law.

Not exactly a libertarian paradise, but a darn sight better than, say, East Germany.

Now?

For anyone not at the top of the Western power structure, the liberal world order looks more like a biomedical surveillance state. Object too loudly to its dictates and you’re liable to get the Canadian trucker treatment. Your function within the liberal world order is to pay your taxes and participate in a meaningless electoral ritual every four years.

Oh, and maybe sacrifice your sons to the draft?

Oh, and maybe sacrifice your sons to the draft?

Weeks before the invasion, folks at the top of the Western power structure were speculating openly that U.S. troops might be called upon to “roll back Russians.”

But where would those troops come from?

“The Army, along with the other services, faces an ongoing crisis to fill in the ranks,” said a recent report at Military.com. “So far, the Army has only hit about 40% of its recruiting goals this year.”

Last month, the Army announced a new policy allowing young people to enlist without a high-school diploma or a GED — and then did an immediate about-face. “The move was met with some mockery online and accusations of it being a desperate measure, lowering standards to fill in the ranks wherever the Army could.”

All the Army can do to grow its numbers right now is tinker at the margins — like relaxing its tattoo policies. Meanwhile, U.S. troop numbers in Europe are already the highest since 2005, and military planners surely want to raise them still higher.

Reinstating the draft would solve the problem.

Granted, there’d have to be a lot more buy-in among both younger and older generations than would be the case now. But an “incident” that kills a couple dozen U.S. troops at a base in Europe might make a critical mass of the public forget all about their exhaustion with Washington’s 21st-century “forever wars.”

No, no guarantees it’s going to happen this way. But everyday Americans are tiring of their wartime sacrifice — there were already signs of that in the polling data by late May — and in the tension between their suffering and the elites’ demands, well, something’s gotta give.

Where do you see things going? Does a draft sound plausible to you? We’re keen to take the pulse of our readership — especially if you have draft-age kids or grandkids: feedback@5minforecast.com

To the markets — which are in a “recessionary panic” across the board, even in the absence of any obvious news catalyst.

To the markets — which are in a “recessionary panic” across the board, even in the absence of any obvious news catalyst.

Perhaps it’s the accumulation of a holiday weekend’s jitters: After we went to virtual press Friday afternoon, the Federal Reserve Bank of Atlanta updated its much-watched “GDPNow” model — anticipating second-quarter GDP fell by an annualized 2.1%.

That would be on top of the first quarter’s 1.6% drop. One of the informal definitions of a recession is two quarters of declining GDP. (The official second-quarter number won’t come out until the end of this month.)

By day’s end Friday, the following meme was going semi-viral across social media, even as it might have already become dated…

In any event, today’s a “risk-off” kind of day.

In any event, today’s a “risk-off” kind of day.

Stocks? Selling off hard, with the S&P 500 down 2% to 3,749 — although that’s still comfortably above the June 16 low of 3,666. The Dow is also down about 2% or more than 600 points. The Nasdaq is holding up better, down about 0.8% and holding the line on 11,000 for now.

Precious metals? Selling off hard, with gold down over $40 to $1,765 and silver down 81 cents to 19.17.

Cryptos? Selling off hard, with Bitcoin giving up the $20,000 level and Ethereum under $1,100. (It doesn’t help that the crypto exchange Vauld has suspended withdrawals, trading and deposits; Vauld is backed by both Peter Thiel and Coinbase.)

Crude? Yes, selling off hard — a barrel of West Texas Intermediate down over $9 and back below $100 for the first time in nearly two months.

But bonds are benefiting from the flight to safety — prices up, yields down. The yield on a 10-year Treasury note is down to nearly 2.8%, the lowest since late May. Alas, the 10-year rate is now lower than the 2-year — an “inverted yield curve” that’s also a reliable recession harbinger.

And the greenback is benefiting. The dollar index is up to 106.6, the highest since late 2002. That’s largely a function of weakness in the euro, which makes up 57% of the dollar index. Overnight the euro sank below $1.03 — a 20-year low.

“Seasons change in the market — and there are times when we need to change our approach to match the opportunities the current market is giving us,” says our Zach Scheidt.

“Seasons change in the market — and there are times when we need to change our approach to match the opportunities the current market is giving us,” says our Zach Scheidt.

Since last year, Zach has been pounding the table for readers to get out of go-go growth stocks and into value names. “Value stocks,” he reminds us, “are simply stocks that trade for a low price compared with the earnings the companies generate. When you buy a value stock, you’re investing in a company that is successfully turning a profit. And you’re paying a discount price for those profits.”

Value stocks as a group ended the first half of the year down 8.6% — compared with a 19.2% drop for the S&P 500 and a 29.6% plunge for a basket of growth stocks.

“But even while value stocks pulled back by about 8% in the first half, the true returns for investors were actually better than that,” says Zach. “Most value stocks pay dividends to investors each quarter. And since value stocks earn bigger profits for every dollar you invest, their dividend yields are typically much higher than your average stock.”

After a decades-long stretch of growth outperforming value, Zach says the seasons are changing: “Value stocks could outperform growth plays for years and years. We can do our homework, buy cheap stocks of companies that generate great profits and do quite well!”

And now the most important story the mainstream is utterly ignoring…

And now the most important story the mainstream is utterly ignoring…

The Reuters newswire is on the case, but almost no one else is picking up on it, even among Reuters’ many clients: “Dutch farmers angered by government plans that may require them to use less fertilizer and reduce livestock began a day of protests in the Netherlands on Monday by blocking supermarket distribution hubs in several cities.”

Last month, the Dutch government set targets for reducing nitrogen oxides in the air and water — aiming to comply with a 2019 ruling from the European Court of Justice. The practical effect of those targets would mean slashing the country’s livestock population by 30%.

“Farmers say they have been unfairly singled out and have criticized the government’s approach,” per Reuters. “Monday’s protest is widely supported by farmers’ groups but not centrally organized.”

To be sure, this issue is more complex than bogus “climate change” dictates. Nitrogen oxide does fuel acid rain — and nitrogen oxide in fertilizer runoff is a major cause of algae blooms that choke off marine life in lakes.

Still… farmers see the heavy hand of government threatening their livelihood. But their show of force doesn’t fit with the corporate media’s agenda… so it’s up to folks like us to tell you about it.

To the mailbag… where we see readers perked up at our mention of the latest helium shortage.

To the mailbag… where we see readers perked up at our mention of the latest helium shortage.

[Remarkable: We’ve been doing this for 12 years and we’re still surprised sometimes at what gets folks’ attention…]

From Idaho: “I judge helium shortages by the Dollar Tree (or, as I now call it, ‘The 4-4-5 Store’). If they’re still selling helium party balloons at the regular price and have plenty in inventory, then all’s right with the helium world. And as of last week, they were, and they did.”

Writes another reader: “So a few weeks or so ago, we were discussing the shortage of neon gas, because Ukraine. Actually, neon is extracted from the atmosphere so it could be done anywhere, but folks figured that it was cheaper just to buy it from someone else.

“Now we’re talking about a shortage of helium gas. Well, the United States is the largest helium producer worldwide. In 2021, the production of helium in the U.S. stood at approximately 77 million cubic meters, taking into account helium extracted from natural gas and helium production from the Cliffside gas field in Texas.

“Second is Qatar at 51 million cubic meters, followed by Algeria at 14 million cubic meters. Russia is indeed No. 4, but it only produced 9 million cubic meters in 2021.”

The 5: “A primary contributor to the latest shortage,” says an April article at Physics Today, “was a leak that caused an unplanned mid-January shutdown at the Cliffside crude helium enrichment plant, which is operated by the Bureau of Land Management to process raw helium gas from the Bush Dome reservoir in Texas.

“The closure, which followed a four-month outage of the plant last year, has removed a source that usually provides around 14.2 million cubic meters per year from the reservoir.”

Near as we can tell, Cliffside has been up and running again since May. But surely an outage that long, on the heels of another one the previous year, isn’t helping matters…

“Happy Fourth! How about an Assange update?” says an email that arrived over the long weekend.

“Happy Fourth! How about an Assange update?” says an email that arrived over the long weekend.

The 5: On Sunday, Julian Assange spent his 51st birthday the same way he spent his 50th — in London’s Belmarsh prison, awaiting trial in the United States on charges he violated the Espionage Act of 1917.

Last month, the U.K.’s home secretary signed off on Assange’s extradition. His lawyers still have a couple avenues of appeal within the U.K., and it appears they’ll pursue those avenues… but at this stage, it seems like merely forestalling the inevitable.

So really, not much has changed since we last lamented the plight of Assange and the threat to a free press.

But we’ll aim to do more regular updates as developments warrant — because God knows the Establishment press has tuned out.

Best regards,

Dave Gonigam

The 5 Min. Forecast